If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new Continue Reading

Archives for July 2024

How To Determine if You’re Ready To Buy a Home

If you’re trying to decide if you’re ready to buy a home, there’s probably a lot on your mind. You’re thinking about your finances, today’s mortgage rates and home prices, the limited supply of homes for sale, and more. And, you’re juggling how all of those things will impact the choice you’ll make.While housing market conditions are definitely a factor in your decision, your own personal Continue Reading

Why Working with a Real Estate Professional Is Crucial Right Now

Navigating the housing market can be tricky, especially these days. That's why having an experienced guide when buying or selling a home is so important. The market isn't exactly straightforward right now, and working with a real estate expert can offer insights and advice that make all the difference.While today’s market conditions might seem confusing or overwhelming, you don't have to handle Continue Reading

How Do Presidential Elections Impact the Housing Market?

Some HighlightsAre you wondering if the upcoming election will have an impact on the housing market? Here’s what history tells us you need to know if you’re considering a move.Data shows home sales slow in November but quickly bounce back and rise the following year. Prices usually keep climbing. And mortgage rates typically come down slightly.Presidential elections have only a small and Continue Reading

Why Moving to a Smaller Home After Retirement Makes Life Easier

Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits your needs. If it's too big, too costly, or just not convenient anymore, downsizing might help you make the most of your retirement years. To find out if a smaller, more manageable home might be Continue Reading

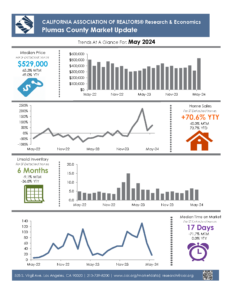

May Market Report

The Price of Perfection: Don’t Wait for the Perfect Home

In life, patience is a virtue – but in the world of homebuying, waiting too long in hopes of finding the perfect home actually isn't wise. That’s because the pursuit of perfection comes at a cost. And in this case, that cost may be delaying your dream of homeownership. As Bankrate explains:“One of the most common first-time homebuyer mistakes is looking for a home that checks each of your boxes. Continue Reading

Why Your Asking Price Matters Even More Right Now

If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing.While home prices are still appreciating in most areas, they’re climbing at a slower pace because higher mortgage rates are putting a squeeze on buyer demand. At the same time, the supply of homes for sale is growing. Continue Reading

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:“Though many Americans believe the housing market is at risk of crashing, the Continue Reading

Things To Avoid After Applying for a Mortgage [INFOGRAPHIC]

Some HighlightsThere are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table.Don’t change bank accounts, apply for new credit, make any large purchases or transfers, and don’t co-sign loans for anyone. Here’s a good rule of thumb. Always connect with your loan officer before making any financial decisions Continue Reading